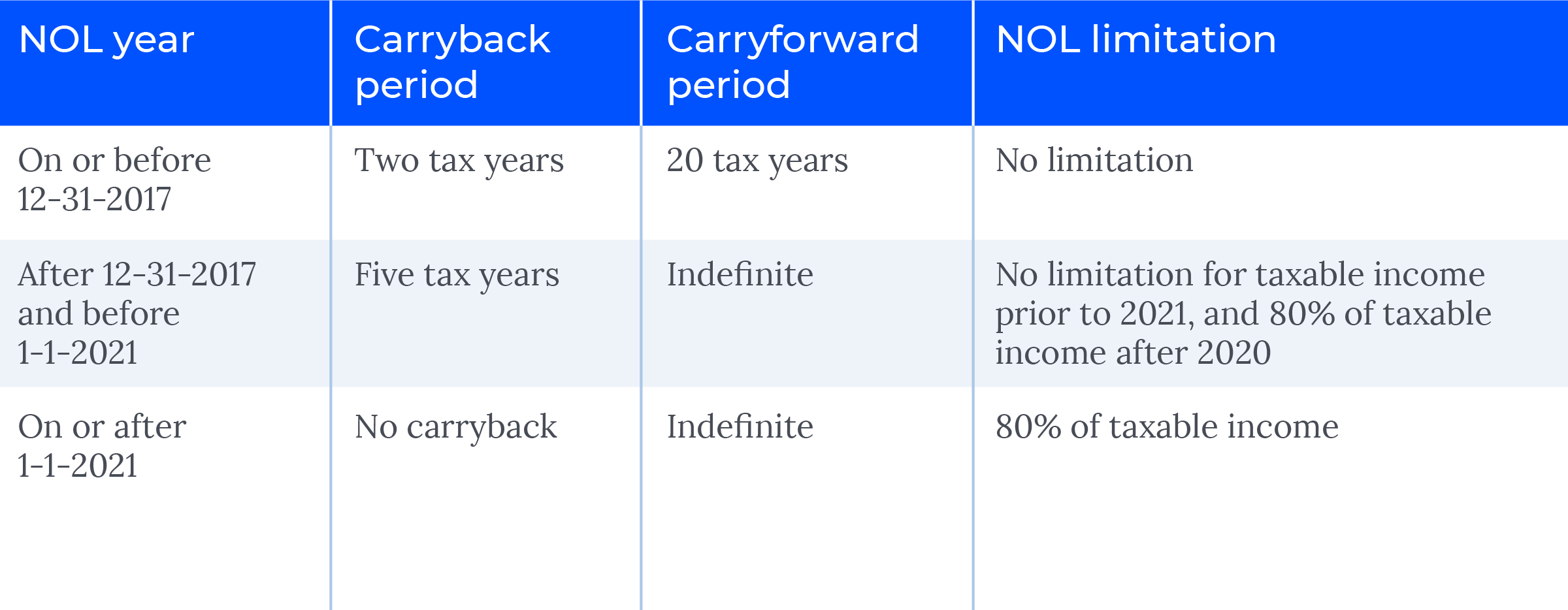

Nol Carryback 2025 Rules And Regulations. The tax cuts and jobs act (tcja) made significant changes to nol rules. However, if a refund is attributable to an nol carryback, a claim for refund can be filed within 3 years of the due date (including extensions) of the nol source year return.

State nol rules may differ from federal rules. The tax cuts and jobs act (tcja) made significant changes to nol rules.

NOL Carryback Rule C.A.R.E.S NOL Carryback Provision, Businesses and individuals must reevaluate their tax strategies in.

What Are Net Operating Loss Carrybacks? Tax Foundation, Adapting to the 2025 changes in nol carryback and carryforward rules requires a proactive approach to tax planning.

Tax relief options for real estate brokers Wipfli, The tax cuts and jobs act (tcja) made significant changes to nol rules.

Can a C corporation Carryback NOL’s? Universal CPA Review, Limiting nol deductions to 80% of taxable income, disallowing nol carrybacks, and lifting.

Can a C corporation Carryback NOL’s? Universal CPA Review, Some jurisdictions introduced carryback rules, allowing businesses to apply nols to past tax years, resulting in a tax refund.

Corporate Nol Carryover Rules, Net operating loss (nol) provisions are critical considerations for startups and smes planning their global expansion.

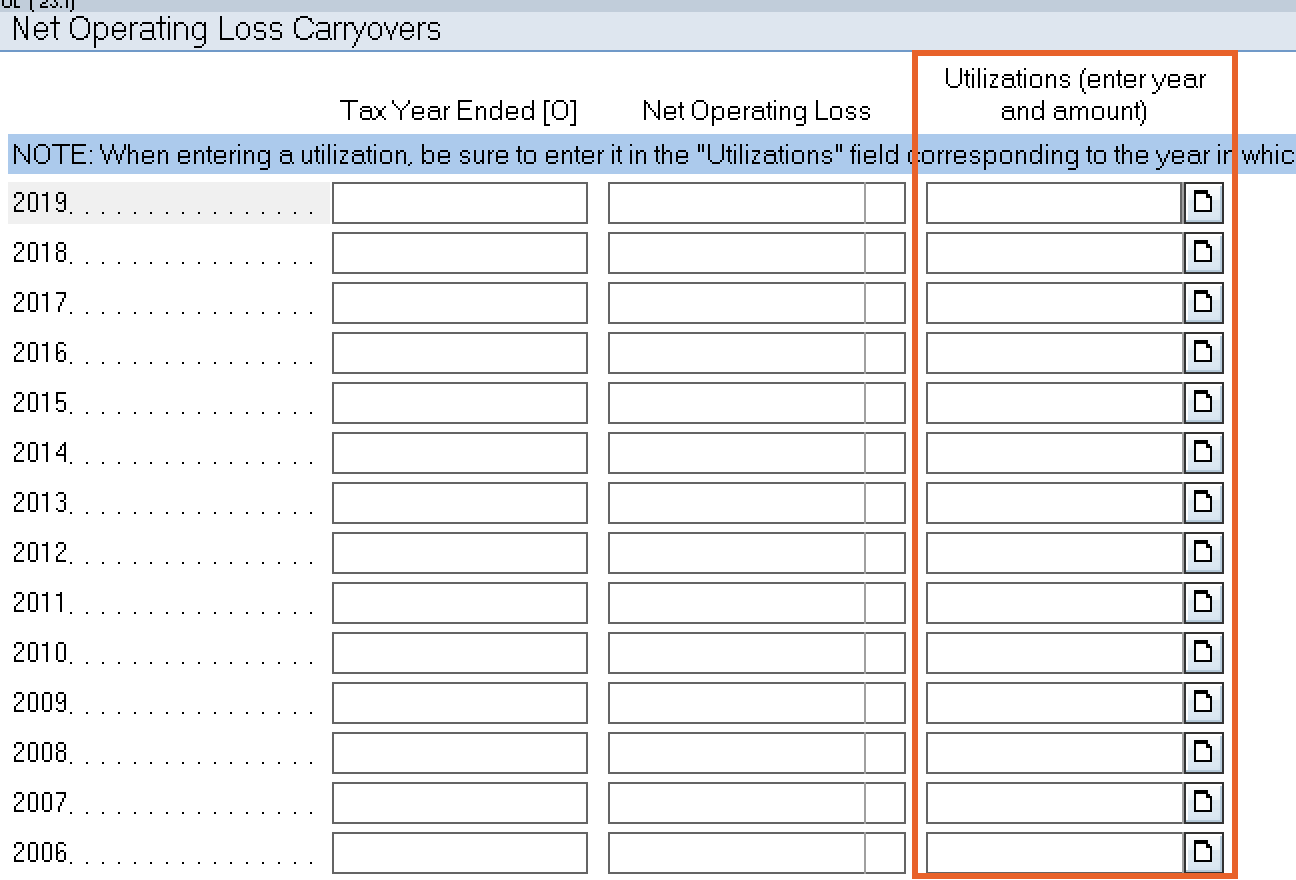

Solved E1923 (LO3) (NOL Carryback and Carryforward,, Adapting to the 2025 changes in nol carryback and carryforward rules requires a proactive approach to tax planning.

Can a C corporation Carryback NOL’s? Universal CPA Review, Businesses and individuals must reevaluate their tax strategies in.

What is NOL Loss Carryback?, Limiting nol deductions to 80% of taxable income, disallowing nol carrybacks, and lifting.